WHAT ARE THE COSTS OF INVESTING IN WHISKY?

Investing in cask whisky is cost-effective, hassle-free, and highly secure. Regulated by strict HMRC (Her Majesty’s Revenue and Customs) guidelines, casks of single malt whisky must be stored within Scotland in HMRC bonded facilities. While many casks are stored at the distillery’s bonded facilities, there are bonded warehouses across the country and diversification is common practice to mitigate risks, such as fire damage.

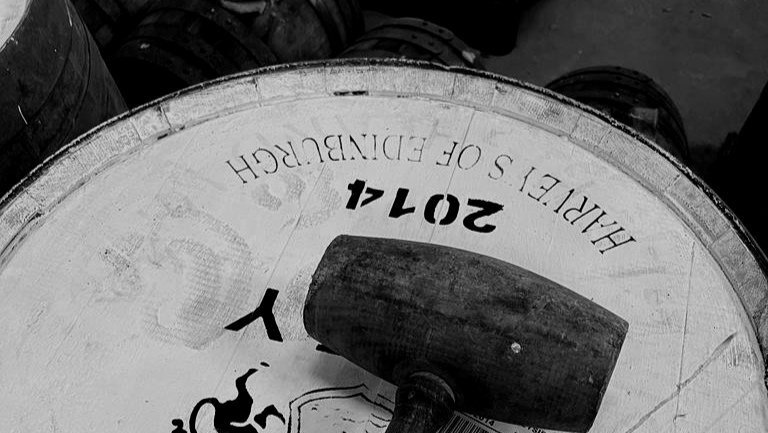

WAREHOUSING COSTS.

Warehousing fees for a cask vary based on facility prestige and location, typically averaging around £80-£100 per cask annually.

DUTY, VAT, AND TAXATION.

While we recommend seeking independent tax advice, here are some essential points:

• All cask whisky is held under bond in Scotland and as a result is exempt from VAT. Casks that are brokered on whilst still in bond are not subject to these taxes. It is only at the point of bottling, when the cask is to be removed from bond, that excise duty and VAT will be due.

• Ferguson Whisky hold a WOWGR license. The term WOWGR stands for Warehousekeepers and Owners of Warehoused Goods Regulations and licences are strictly controlled. A certificate obtained under these regulations allows a business to move goods with the payment of duty suspended from one bonded warehouse to another.

• In addition, For UK tax payers, UK Capital Gains Tax is not regarded as applicable because cask whisky is a “wasting chattel” as a result of the “angel’s share” (evaporation).